Unclaimed Billions in M-Pesa Wallets Transferred to UFAA

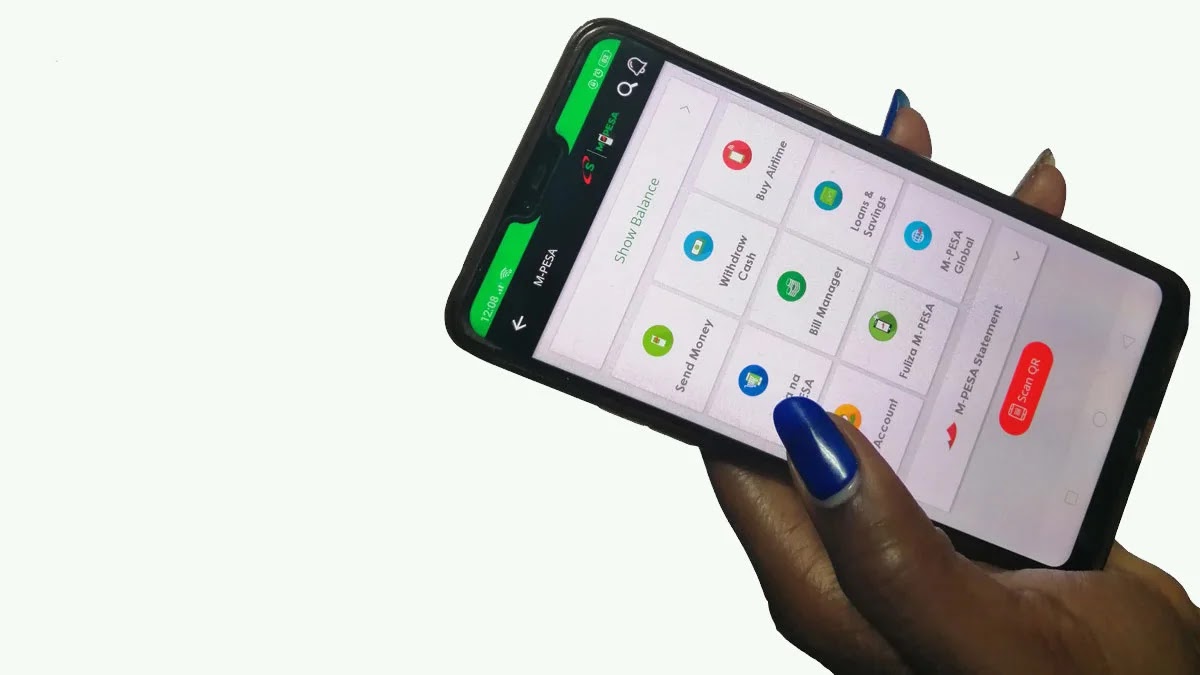

An astonishing Sh3.2 billion in uncollected M-Pesa cash has fallen into the hands of the Unclaimed Financial Assets Authority, UFAA, in a revelation that points to the rich piles of idle cash left behind in Kenyan mobile wallets.

A majority by M-Pesa

Of the cash rendered dormant and domiciled with UFAA, M-Pesa, as of November 11, 2024, holds 96.3% of what was surrendered to UFAA. Airtel users have left unclaimed Sh114.3 million. Telkom Kenya was holding Sh7 million in the dormant wallets.

The money is always deposited, but it goes idle when telephone lines have not been in use for more than two years. In most cases, the owners of such lines are long deceased, have left the country, or lost their sim cards and replaced none.

Legal Framework of Unclaimed Assets

The UFAA Act stipulates that any deposit or prepayment for services not claimed for over two years shall be considered abandoned. In this case, telcos, Safaricom, Airtel, and Telkom, are required to pay unclaimed funds annually before November 1st. If they fail to do so, the penalties will entail fines up to 25% of the asset value, with an added penalty of Sh7,000 to Sh50,000 for every day of default.

These firms are also supposed to search for the rightful asset owners, heirs included, before the funds can be declared unclaimed. Being the case that most accounts apply, the traditional ways such as publishing names in the newspapers are not workable.

Challenges in Reuniting Owners with Funds

Safaricom says that unclaimed cash is usually in small bits accumulated on millions of accounts and, therefore, quite cumbersome to look for their owners. The beneficiaries of a dead person can claim through presenting the death certificate with administration letters among other legal documents.

Notwithstanding these provisions, many Kenyans seem to care little about claiming this money. Inheritance disputes and lack of information have further contributed to reconnecting beneficiaries with their rightful assets.

Growth of Unclaimed Assets

Unclaimed assets comprise cash, shares and dividends that increased by 21.7 per cent to Sh 75.5 billion as of November 2024 from Sh62 billion in June. Billionaires, retired government officials and politicians hold sizeable shares of the unclaimed wealth held in surrendered securities amounting to Sh39.4 billion. Additionally, abandoned safe deposit boxes containing their contents including jewelry, title deeds, and share certificates increased from 1,953 units from June to 3,737 units. Over 9.87 million unit trusts together with a sizeable cash balance still held by banks, insurance, and pension schemes are unclaimed as well.

Mobile Wallet Donations

Currently, there's an upward trend of unclaimed assets is in mobile money accounts. Money surrendered from MNOs reached Sh827.7 million in 2024 from Sh541.7 million in 2023. Essar that operated under the Yu brand before exiting Kenya in 2014 retains Sh2.1 million in dormant accounts. Microfinance platforms Branch and Tala add Sh1.38 million and Sh167,394 respectively.