How Money Market Funds (MMFs) Work in Kenya: A Complete Guide to Investing and Earning Returns

Introduction

Money Market Funds (MMFs) have become very popular in Kenya as a low risk investment that gives good returns and liquidity. Whether you are a new investor or looking for a safe place to grow your savings, MMFs are a great alternative to traditional savings accounts.

In this article we will cover:

What MMFs are and how they work in Kenya

How interest is calculated in MMFs

Best MMFs in Kenya and their returns

How to open an MMF account

Difference between MMFs and bank savings accounts

Risks and benefits of investing in an MMF

What is a Money Market Fund (MMF)?

A Money Market Fund (MMF) is a type of unit trust that pools money from different investors and invests it in short term, low risk financial instruments such as:

Treasury bills (T-bills)

Fixed deposits in banks

Corporate bonds

Commercial paper

MMFs are managed by licensed fund managers who allocate investments to maximize returns while ensuring security and liquidity.

How does a Money Market Fund work in Kenya?

Investment Contributions – Investors put in money into an MMF account which is pooled with money from other investors.

Fund Management – The fund manager invests in low-risk assets such as T-bills, fixed deposits and short-term bonds.

Earnings & Interest Calculation – Interest is accrued daily and compounded periodically (usually monthly).

Withdrawals – Investors can withdraw their money anytime and get the funds within 24 to 48 hours.

How MMF Interest is calculated in Kenya

MMF interest rates are quoted as annualized yields, but they accrue daily. Here is how it works:

If an MMF gives a 10% annual return, the daily rate is calculated as:

10% ÷ 365 = 0.0274% per dayIf you invest KES 100,000, your earnings per day would be:

100,000 × 0.0274% = KES 27.40 per dayAt the end of the month, your balance will grow based on daily compounding.

Example of MMF Returns

| Investment Amount | Annual Interest Rate | Monthly Return Estimate |

|---|---|---|

| KES 10,000 | 10% | ~KES 83 |

| KES 50,000 | 10% | ~KES 417 |

| KES 100,000 | 10% | ~KES 833 |

Best Money Market Funds in Kenya (2025)

Some of the top performing MMFs in Kenya based on interest rates and reliability are:1. CIC Money Market Fund – ~11% p.a.

NCBA Money Market Fund – ~10.5% p.a.

Sanlam Money Market Fund – ~10.2% p.a.

Zimele Money Market Fund – ~9.8% p.a.

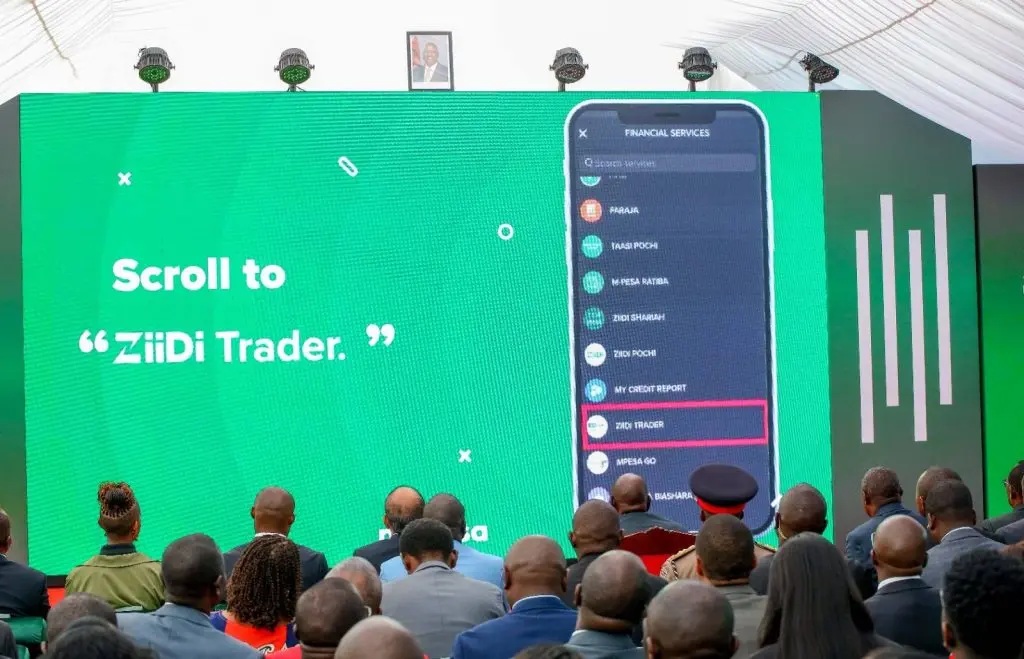

Safaricom Ziidi MMF – ~9.5% p.a.

How to open an MMF account

You can open an MMF account through licensed fund managers or platforms like M-PESA Ziidi. The process is:

Choose a Fund Manager – Compare MMFs based on returns, fees and accessibility.

Fill in Registration Forms – Provide personal details and KYC documents (ID, KRA PIN, bank/M-PESA details).

Make an Initial Deposit – Most MMFs require a minimum investment of KES 100 to KES 5,000.

Start earning interest – Once your funds are invested, you start earning daily interest.

MMF vs Bank Savings Account – Which is better?

| Feature | Money Market Fund (MMF) | Bank Savings Account |

|---|---|---|

| Interest Rate | 8%-12% per year | 1%-4% per year |

| Liquidity | Withdraw in 24-48 hours | Instant withdrawals |

| Risk Level | Low | Very low |

| Minimum Deposit | As low as KES 100 | Varies by bank |

Risks and benefits of investing in MMFs

Benefits:

✅ Higher returns than savings accounts

✅ Low risk investments in government securities

✅ Daily interest accrual and flexible withdrawals

✅ Suitable for short term savings and emergency funds

Risks:

⚠️ Interest rates fluctuate depending on market conditions

⚠️ Some MMFs may have withdrawal restrictions or delays

⚠️ Returns are subject to a 15% withholding tax